We Unlock the Financial Potential

of your Feedlot Supply Chain

So you can put more cattle on feed

Frequently Asked Questions

Who is the Lender ?

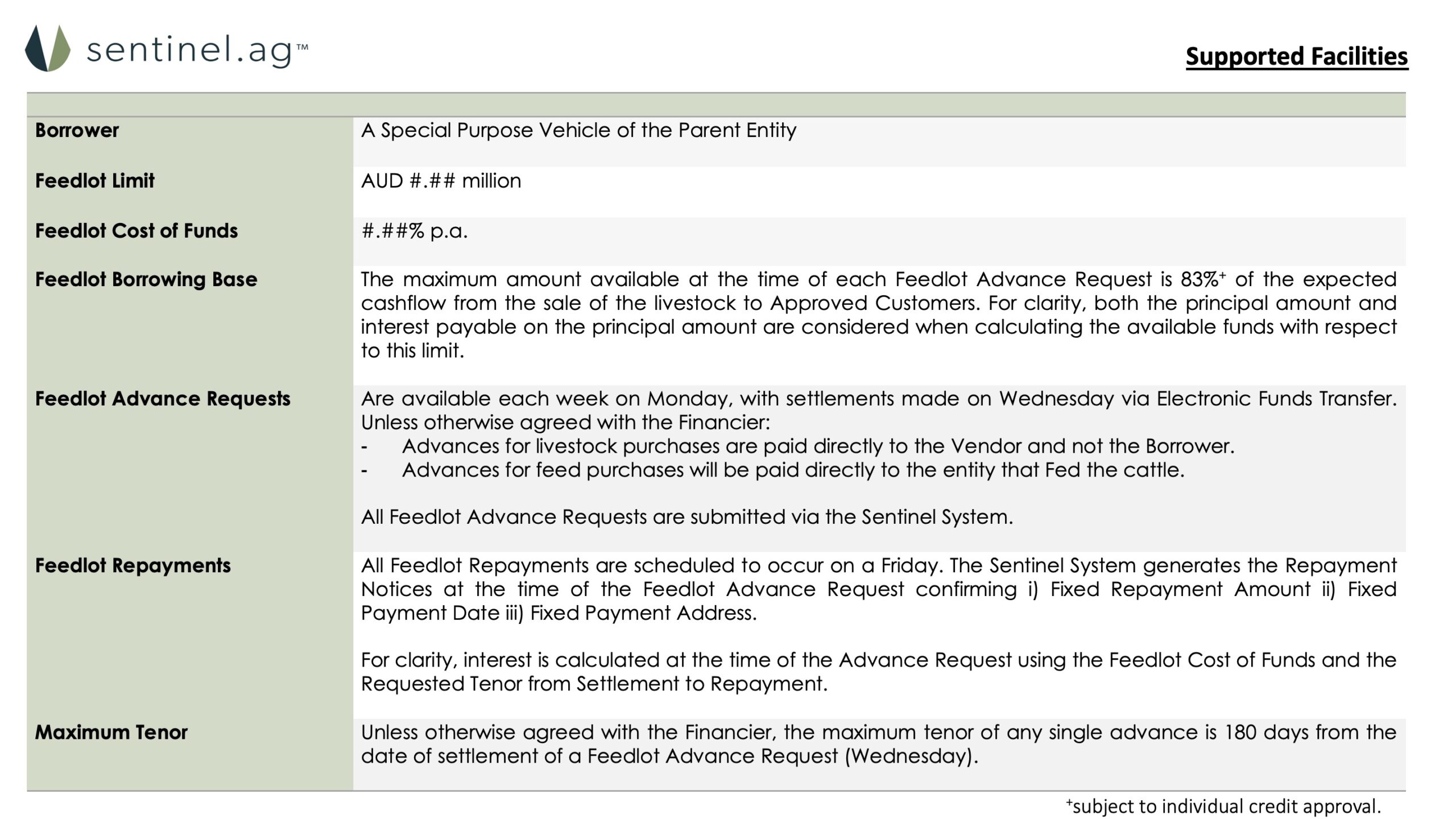

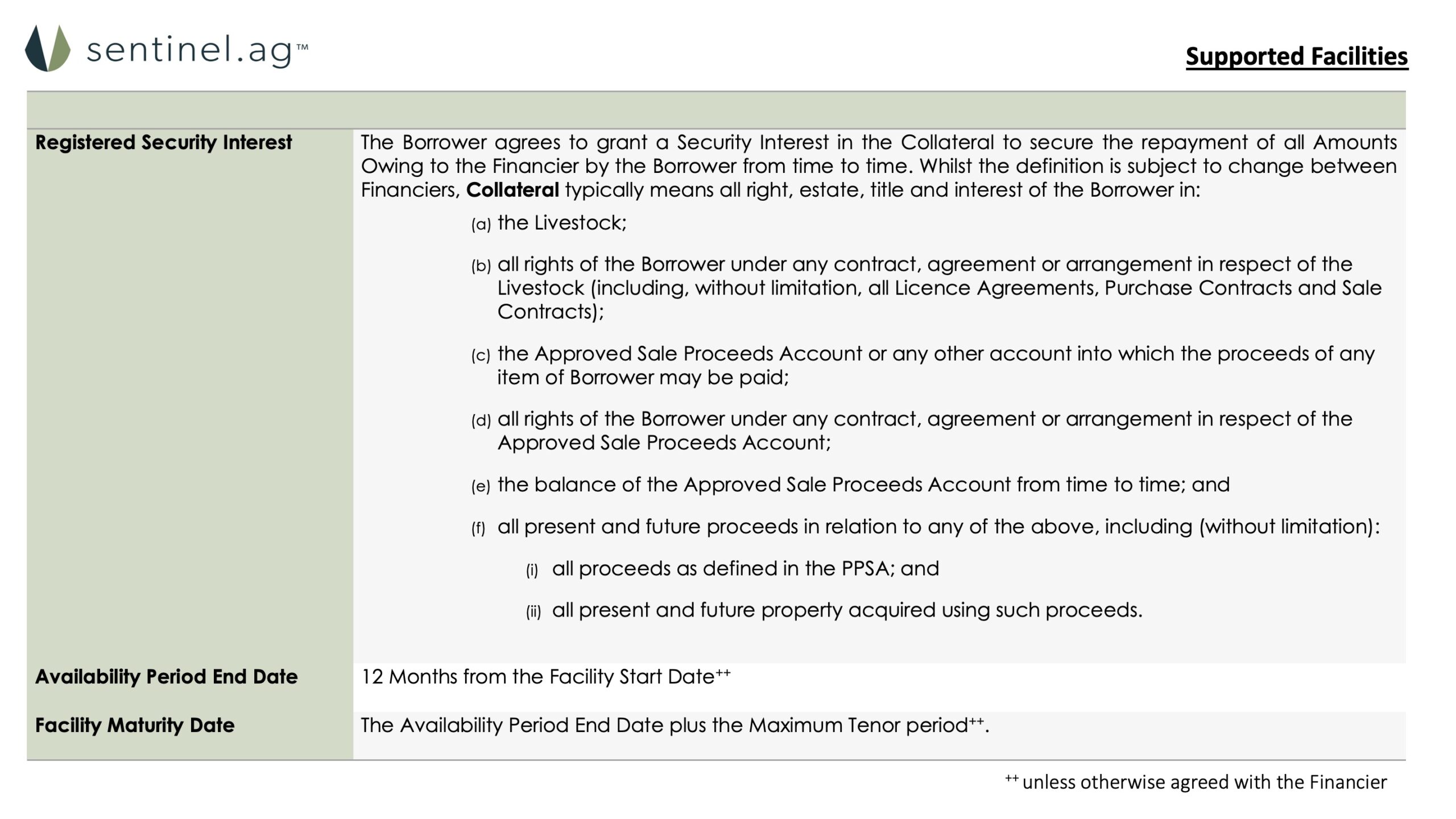

Sentinel Ag works with foreign and domestic banks that are regulated by the Australian Prudential Regulation Authority (APRA) in accordance with the Banking Act. In all instances, these banks will be the lender not Sentinel Ag.

What is the Interest Rate ?

Interest Rates vary on a case-by-case basis. When setting your Interest Rate, Financiers will typically take into consideration: your Credit Risk, the Credit Risk of your Off taker and the interest rate benchmarks of global financial markets (such as BBSW, LIBOR and SOFR).

How often does Sentinel Ag Require Information ?

We require information to be uploaded once per week on Mondays, confirming all commercial activities that occurred in the week prior.

Where needed, additional guarantees and/or security may be requested.

What information is Required by Sentinel Ag ?

Generally speaking, Sentinel only requires information that is readily available through the standard reporting options of your feedlot management system. Including but not limited to Livestock Inductions, Livestock Death Records, Livestock Kill Sheets, Livestock Sales Contracts. All information is easily uploaded directly to the Sentinel System in CSV and PDF file formats. We do not require an API connection to your feedlot management system.

How Does Sentinel Ag get Paid ?

Clients pay a fee when each funding request is submitted through the Sentinel Ag Platform. Sentinel submits its tax invoices directly to the Client for its services. For clarity Sentinel is not paid any fees or trailing commissions by the Financier.

What are the Next Steps ?

Use this website to schedule a call back at a time that is convenient to you. This call is free of cost and obligation on both parties. It is simply an opportunity to connect and see if it makes sense to work together.